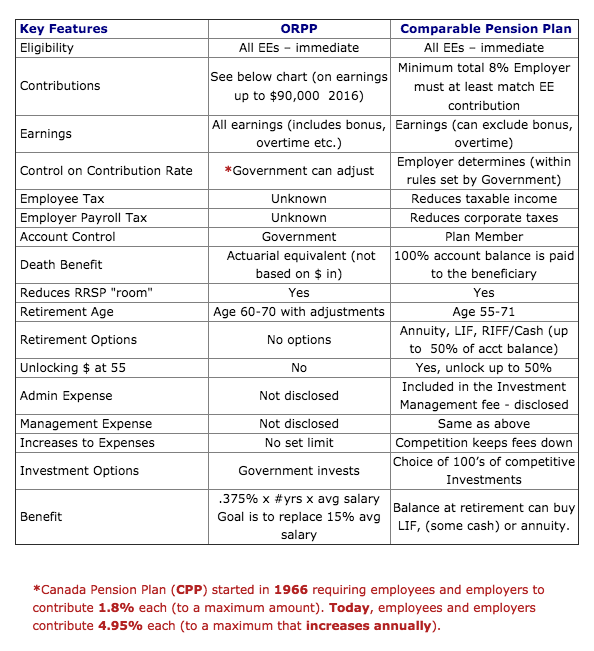

In less than two years, the Ontario government will begin rolling in the Ontario Retirement Pension Plan (ORPP). This plan is, “a pension solution to help Ontario workers retire with greater financial security.”*

In an article recently published in Benefits Canada by Craig Sebastiano, he provided a clear overview about the ORPP we’d like to share.

Defined Contribution (DC) plans will be considered comparable if they are locked in, be regulated by existing provincial pension standards, and meet a minimum contribution threshold (an annual contribution rate of 8% and require at least 50% matching of the minimum rate from employers).

In order for Defined Benefit (DB) plans to be considered comparable, they will need to be equal or exceed the benefits being offered through the ORPP. The minimum comparability threshold that earnings-based DB plans will need to meet is an “annual benefit accrual rate of at least 0.5%.”

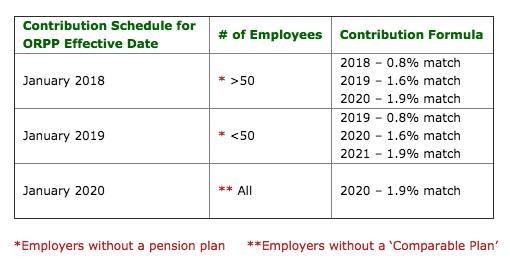

Enrollment in the ORPP will be staged in four waves:

- Wave 1 – January 1, 2017: Employers with 500 or more employees without registered workplace pension plans

- Wave 2 – January 1, 2018: Employers with 50 to 499 employees without registered workplace pension plans

- Wave 3 – January 1, 2019: Employers with fewer than 50 employees without workplace pension plans

- Wave 4 – January 1, 2020: Employers with a workplace pension plan that’s not modified or adjusted to meet the comparability test as well as employees who aren’t member of the workplace’s comparable plan

For Waves 1 to 3, employer and employee contribution amounts will be phased in starting at 0.8% each in the first year, 1.6% each in the second year, and 1.9% each in the third year. For Wave 4, employer and employee contribution amounts will be 1.9% each.

The ORPP Administration Corporation will contact all Ontario employers in early 2016 to verify their existing plans. Employers with a registered workplace pension plan that exists on August 11, 2015, or that’s begun the process of registering one, will be assigned to Wave 4.

“If the plan meets comparability thresholds by the time Wave 4 begins, the employer will not be required to enroll in the ORPP,” the government says.

Any employer that doesn’t have a workplace plan but sets up a comparable plan prior to its entrance wave will not be required to enroll in the ORPP.

– SOURCE: BENEFITS CANADA

In summary, it appears that if you don’t have a pension plan in place now or are not currently setting one up, any new plan set-up must have a minimum matching 4%-4% contribution moving forward.

If you do currently have a pension plan in place and have 2%-2% matching, you will have until January 1, 2020 to move it to a minimum 4%-4% matching plan.

We are still waiting for clarification on the following: If you have an Registered Retirement Savings Plan (RRSP) currently in place, do you have until 2020 to switch to DC plan, or are you held to the dates in Wave 1,2 or 3?

We will continue to monitor the information as it rolls in. When you are ready to discuss your company’s best options for a pension plan, please don’t hesitate to contact us at The Winch Group.

* For more details on ORPP, please visit the Ontario Government website: www.ontario.ca/page/orpp-ontario-retirement-pension-plan